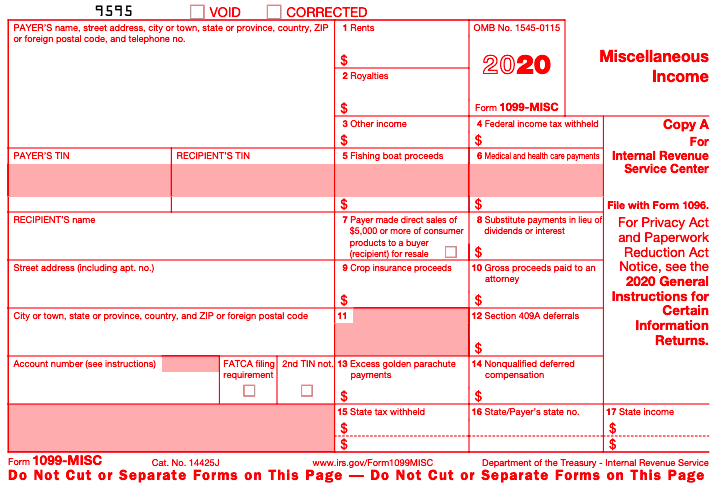

1099 MISC Tax Forms

1099 MISC Tax Forms. It is unlawful to duplicate, copy, or try to create your own form in any way. You MUST obtain the proper tax form directly from the IRS, from an office supply store, from your property management company or from your attorney.

There is a cost to order 1099 forms. Before ordering a 1099, ask your attorney, accountant, or property manager if they can provide you with your 1099 forms for free. Edgington Management will provide you with the necessary tax forms. You may contact us here https://www.edgingtonmanagement.com/contact-a-property-manager-now.

Here is a link to the IRS website: http://www.irs.gov/uac/Form-1099-MISC,-Miscellaneous-Income-

1099 Misc tax forms are used for real estate gains. Also, this is the form you will use for payments from your broker. Further, any dividends or royalties that you receive would be filed by use of a 1099 Misc. Likewise, any gambling earnings or lottery winnings would be reported in a similar way. A 1099 R is slightly different and used more for retirement gains. Specifically, IRAs and pension plans. As well as any annuities, insurance payments or survivor benefits. A w-2 is used for payroll tax. For this reason, we focus less on w-2 payments and more on capital gains.